Research Interests

My research interests are primarily in macroeconomics, monetary economics, and applied time series (macroeconometrics). I am particularly interested in studying the interaction between monetary and fiscal policy, financial markets, and the real economy.

Refereed Publications

Interest Rates, Money, and Fed Monetary Policy in a Markov-Switching Bayesian VAR

[Paper] [Supplement Appendix] [Additional Results Appendix]

The B.E. Journal of Macroeconomics, Volume 23, Issue 2, June 2023, pp. 959-997

Abstract: This paper evaluates the roles of short- and long-term private and government interest rates and inside and outside money in the monetary transmission mechanism. With money and credit markets present, changes in monetary policy set off a chain of relative price and portfolio adjustments affecting output and prices. I study interest rate and money supply rules within this monetary transmission mechanism by estimating several Markov-switching Bayesian vector autoregressions (MS-BVARs) on a quarterly U.S. sample from 1960 to 2018. The best-fit MS-BVAR restricts MS to the impact and lag coefficients of the monetary policy and money demand regressions as well as to the stochastic volatilities (SVs) of the structural shocks. Estimates of this MS-BVAR yield evidence of a SV regime which coincides with NBER-dated recessions. This MS-BVAR also identifies a regime switch in the Fed’s interest rate rule and banks’ demand for outside money around the dot com bust of 2000 and again from the 2007–2009 recession and financial crisis to the end of the sample. Counterfactual simulations show the 2007–2009 recession and financial crisis would have not been as deep and long-lasting if the fed funds rate had been as low as −8 % in 2009 and remained negative from 2010 through 2016.

Working Papers

Measuring the Effects of Fiscal Policy Shocks on U.S. Output in a Markov-Switching Bayesian VAR

Latest Draft: 8/27/2025

[Paper] [Supplement Appendix][Conference Slides]

Abstract: Fiscal foresight—the anticipation of and immediate reaction to future policy changes—introduces systematic bias into conventional VAR estimates of fiscal multipliers. This paper addresses this issue using a Markov-switching Bayesian VAR (MS-BVAR) that explicitly models how agents’ expectations of potential regime shifts influence their current behavior and economic outcomes. Using quarterly U.S. data from 1960Q1 to 2019Q4, I find strong evidence of state-dependent policy effects. Government spending multipliers are substantially larger during recessions (1.4 to 1.8) than in expansions (approximately 1.0), while tax multipliers remain consistently small (-0.1 to -0.4) and imprecisely estimated across all regimes. These findings provide empirical support for countercyclical spending policies but reveal a more limited role for tax policy.

Understanding the Effects of Government Spending Shocks: It’s in the Size as Well

with Xiaoxiao Bai (Mississippi State University) and Sebastian Laumer (University of Richmond)

LATEST DRAFT: 10/3/2025

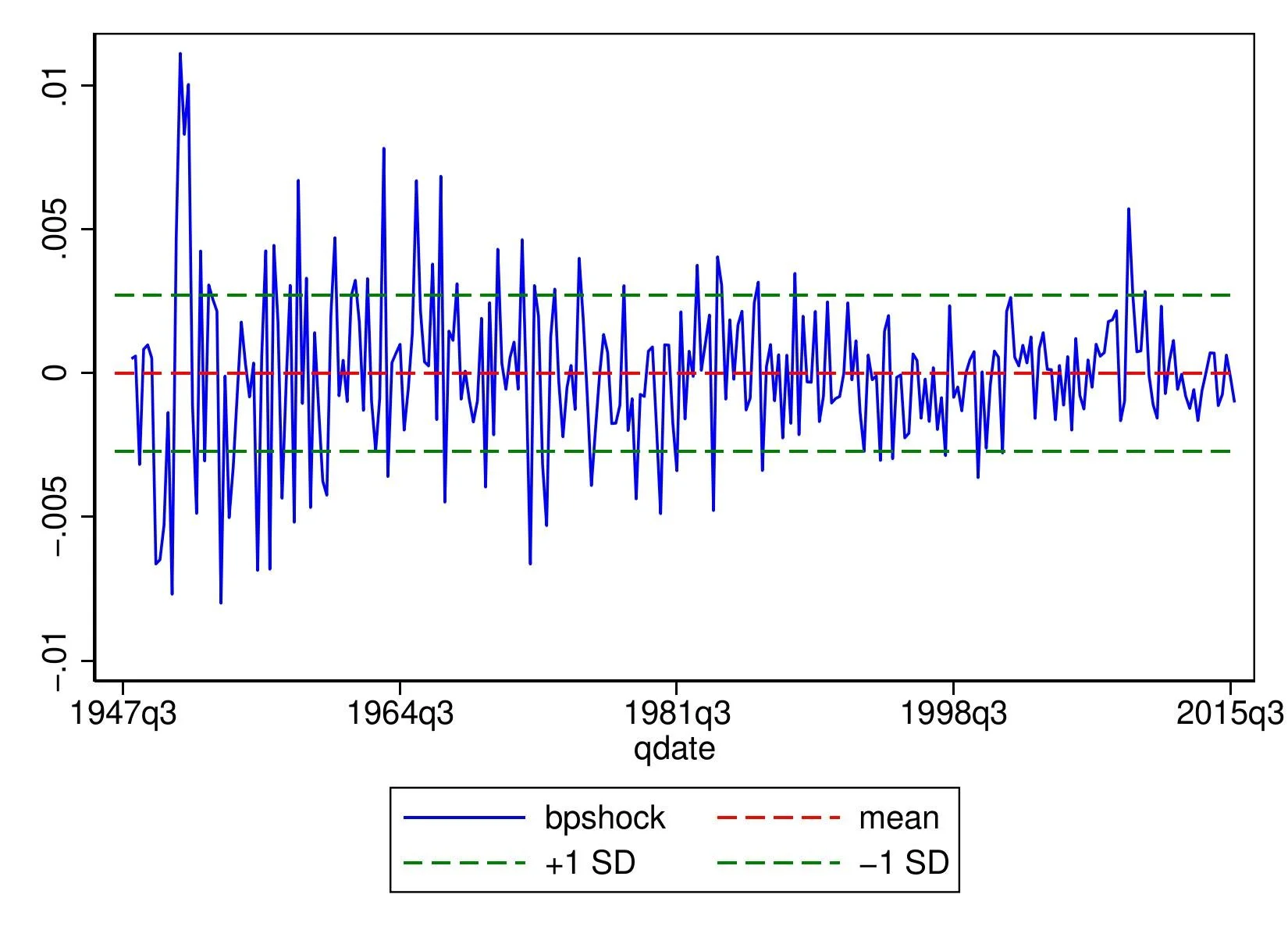

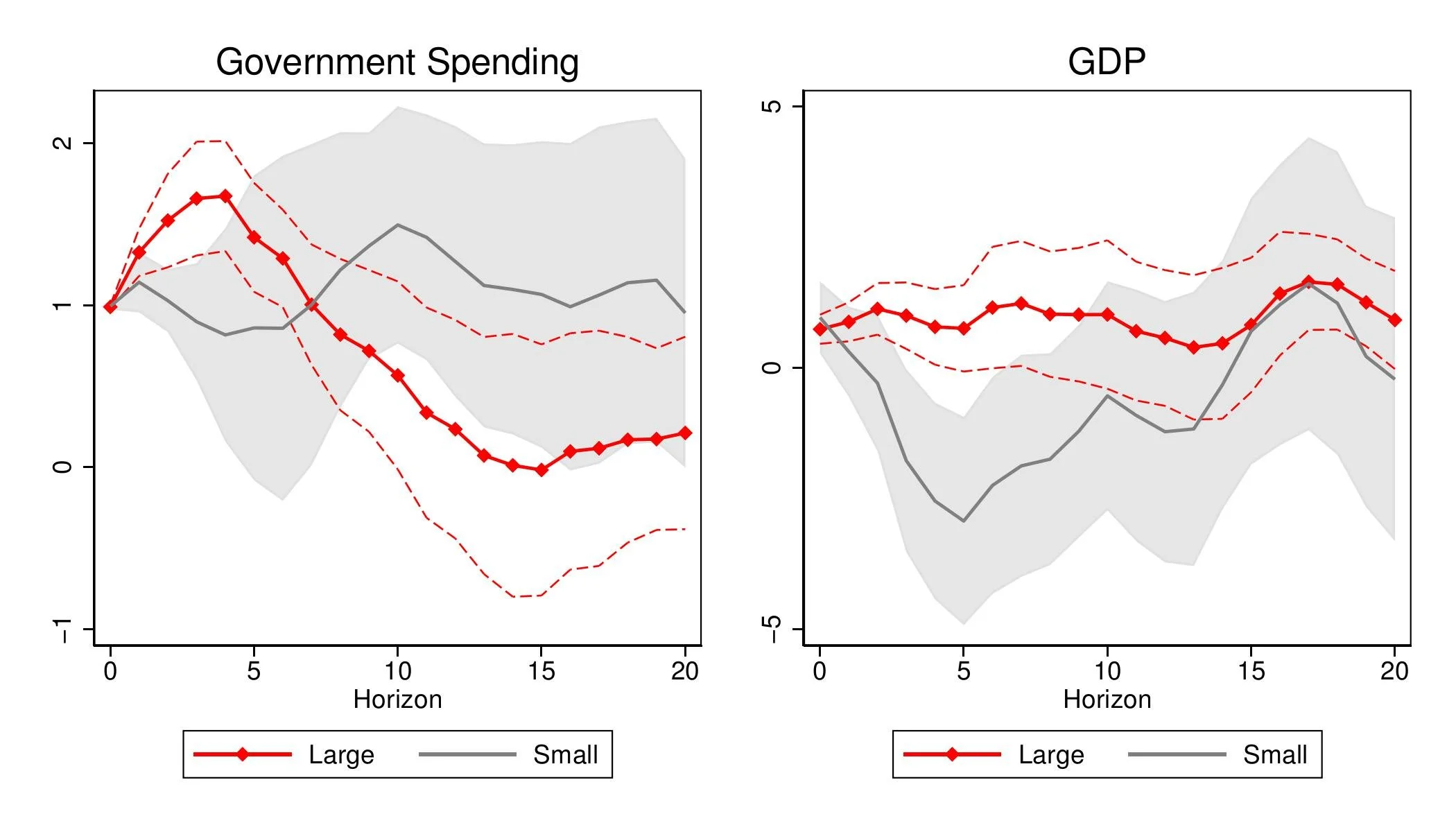

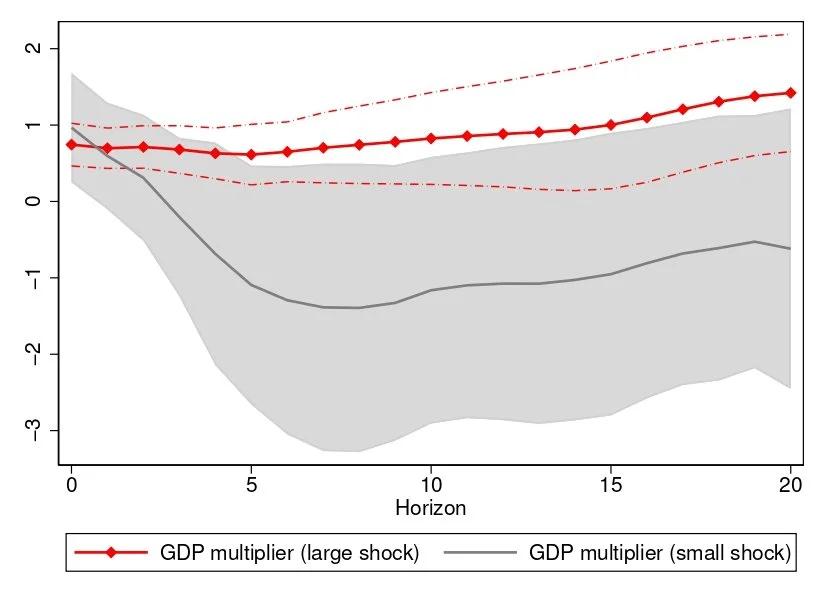

Abstract: This paper investigates whether the macroeconomic effects of government spending depend on the size of the fiscal shock. Using U.S. data from 1947Q1 to 2015Q4, we estimate state-dependent effects of “large” versus “small” spending shocks via local projections. We find strong evidence of size-dependent fiscal multipliers. Large shocks generate an output multiplier near one by crowding in private consumption, whereas small shocks yield a significantly smaller multiplier. These results suggest an intervention's magnitude is critical to its effectiveness, providing empirical support for a “go big or go home” approach to fiscal stimulus.

Work in Progress

“When Money Matters Differently: Asymmetric Effects of Inside and Outside Money Shocks” (with Joshua Hendrickson)

“Same Policy, Different Stories: The Heterogeneous Impact of Monetary Policy Across U.S. Industries” (with Ryan Rholes)

“Money, Liquidity, and U.S. Monetary-Fiscal Policy Interactions”